🤖 The port strike is over… for now.

No agreement has been reached about the future of port automation and semi-automation.

Please note: There have been new developments since this newsletter was automatically scheduled to send which. was before any agreement was made. Here’s what has changed:

A potential economic crisis has been averted after striking workers were called back to work on Thursday. U.S. dockworkers and port operators reached a tentative agreement for a wage hike of around 62% over six years. The agreement also includes provisions to protect workers from automation until both sides return to negotiations on January 15, 2025 to allow time to finalize a new contract regarding the use of automated machinery.

The agreement includes a 62% wage increase over the six-year contract — raising the hourly wage for a top dockworker from $39 to $63 by the end of the contract. This is a significant boost from the initial 50% wage increase offer, though the union had been seeking a 77% raise.

The Port Authority of New York and New Jersey lost between $250–$300 million per day during the three-day strike.

Thank you for your attention.

Key Points

A port strike on the East and Gulf coasts may lead to higher prices for food, autos, and other consumer goods, though the overall economic impact is expected to be moderate.

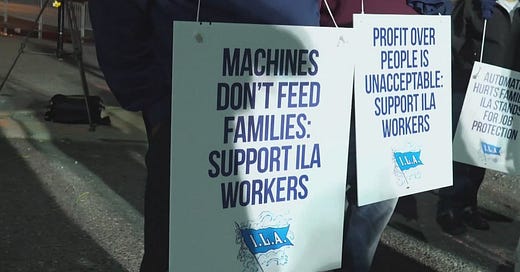

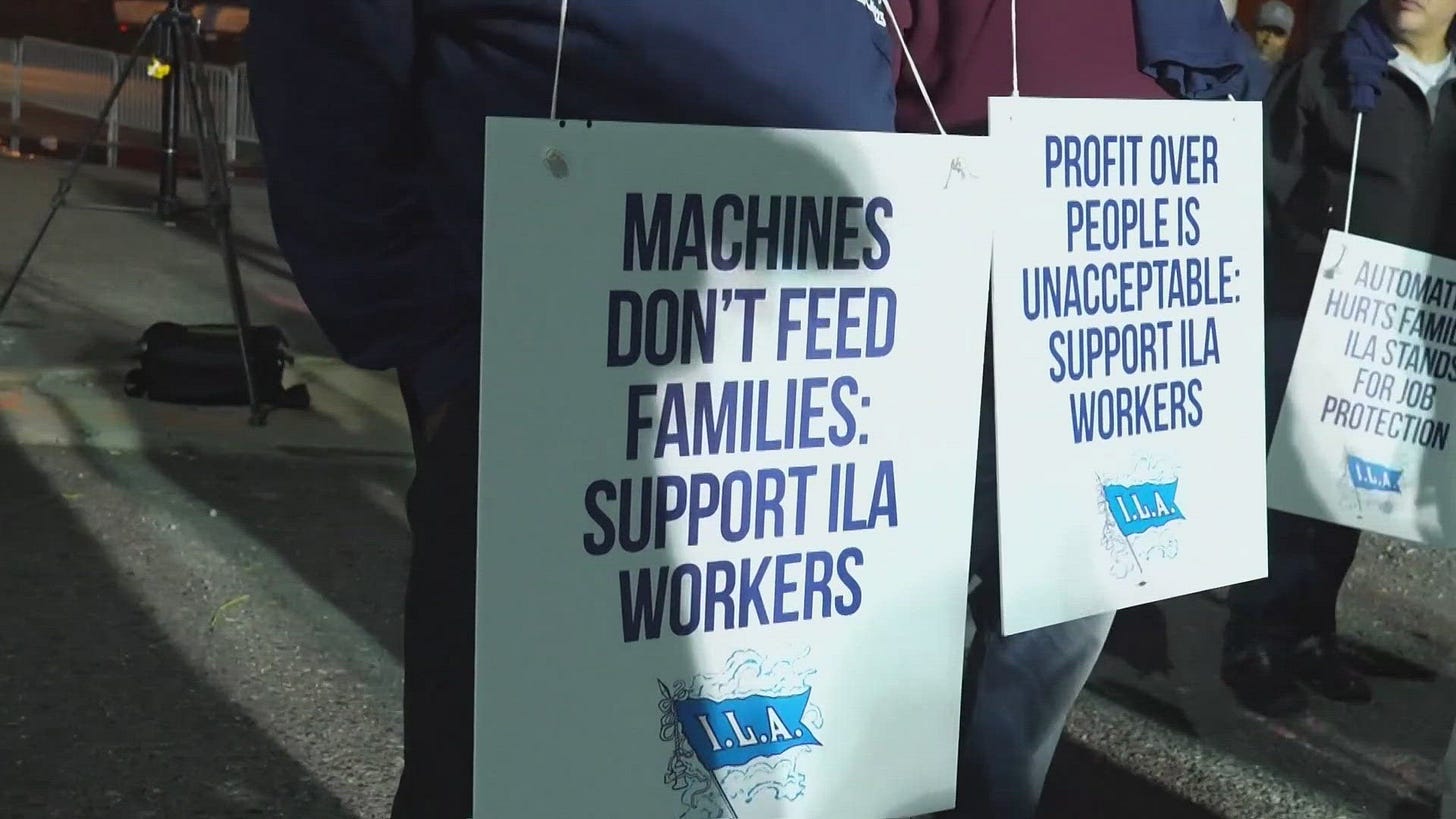

Workers are demanding that any new contract forbid automation at the East and Gulf Coast ports.

Industries most affected include coal, energy, and agricultural products.

There are safety nets in place: West Coast ports are likely to pick up some of the slack, and some businesses have already stockpiled goods in preparation.

Dock workers are on strike, and we're all about to feel the effects. Around 45,000 members of the International Longshoremen's Association (ILA) walked off the job just after midnight on Tuesday, October 1st. This is the first strike by the union since 1977, and they're fighting for higher wages and protections against their jobs being replaced by automation.

The strike is expected to severely disrupt global supply chains and the economy, with American consumers potentially seeing shortages of popular products if it continues. Only 14 East and Gulf Coast ports are affected, but for every day the strike lasts, it could take almost a week to get operations back to normal. This strike could cost the U.S. economy $5 billion a day, leading to shortages and higher prices.

Consumers might notice a lack of perishable goods like bananas, pineapples, mangoes, poultry, soybeans, coffee, and seafood as more than 68% of container exports and 56% of container imports flow through these ports.

Beverages are also at risk of being in short supply or subject to price increases with 80% of imported beer, wine, whiskey and scotch, as well as 60% of rum arriving at East and Gulf coast ports.

Besides international markets like China, Vietnam, and Indonesia – 3.2 million Americans in Puerto Rico could face shortages and rising prices. Over 85% of the island’s food supply comes from the U.S. mainland, and 90% of those shipments go through these ports.

Currently the top hourly wage of $39 is equivalent to $81,000 annually, but dockworkers make significantly more by taking on extra shifts. According to a 2019-2020 report, about one-third of local longshoremen made $200,000 or more a year. A more typical longshoreman's salary can exceed $100,000, but not without logging substantial overtime hours.

As the U.S. enters its peak season for goods, many retailers have prepared by stocking up early. The Taft-Hartley Act which was passed in 1947 allows the U.S. president to pause a strike for 80 days if it threatens national health or safety.

The freight industry is the backbone of the economy and with supply chains already strained, a major port strike could lead to delays, shortages, and higher consumer prices. It’s not just about shipping—this strike could put millions of jobs at risk and disrupt the flow of essential goods nationwide.